Remember when the word "crypto" conjured images of shady online marketplaces and clandestine transactions? Those days, thankfully, are fading. In Indonesia, the narrative surrounding cryptocurrency is undergoing a remarkable transformation, shifting from a niche interest associated with the dark web to a topic discussed openly in mainstream media and even embraced by some traditional financial institutions.

Navigating this shift hasn't been seamless, though. Early associations with illegal activities left a lingering skepticism. Understanding the technology itself can be intimidating, and the volatile nature of the market creates concerns about potential losses. The regulatory landscape, while developing, is still evolving, leaving some uncertainty about the future of crypto in Indonesia.

This article aims to trace the journey of cryptocurrency in Indonesia, exploring how public perception has evolved from its darknet origins to its current, more accepted status. We'll delve into the factors driving this change, the challenges that remain, and what the future might hold for crypto in the Indonesian financial landscape.

This piece explores the changing perception of cryptocurrency in Indonesia. We'll examine how crypto transitioned from being associated with the dark web to gaining mainstream acceptance. Key themes include the factors influencing this shift, the ongoing challenges, and the potential future of crypto in the Indonesian financial world, focusing on themes like regulatory landscape, technological adoption, and investment trends.

From Obscurity to Curiosity: My First Brush with Bitcoin

I remember the first time I heard about Bitcoin. It was around 2013, and a friend, a computer science whiz, was raving about this "digital gold" that was going to revolutionize finance. At the time, it sounded like something straight out of a science fiction novel. I vaguely understood the concept of decentralization but had a hard time wrapping my head around the idea of a currency not controlled by a central bank. Honestly, I dismissed it as a fad, something that would eventually fade away. What I didn't realize then was that this seemingly obscure technology would eventually become a significant force in the global financial system, even in Indonesia. My initial skepticism wasn't unique. Many Indonesians shared similar sentiments, viewing crypto as complex, risky, and potentially tied to illicit activities. However, the increasing media coverage, coupled with the growing number of individuals and businesses adopting crypto, slowly started to change the narrative. The emergence of local crypto exchanges and educational resources made it easier for people to learn about and invest in cryptocurrencies. The Indonesian government's gradual steps towards regulating the crypto industry also contributed to building trust and legitimacy. Today, while challenges remain, the perception of crypto in Indonesia is significantly more positive than it was a decade ago. It's no longer just a niche interest; it's a topic of discussion in mainstream media, a potential investment opportunity for many, and a subject of increasing regulatory scrutiny.

Unveiling the Darknet Origins

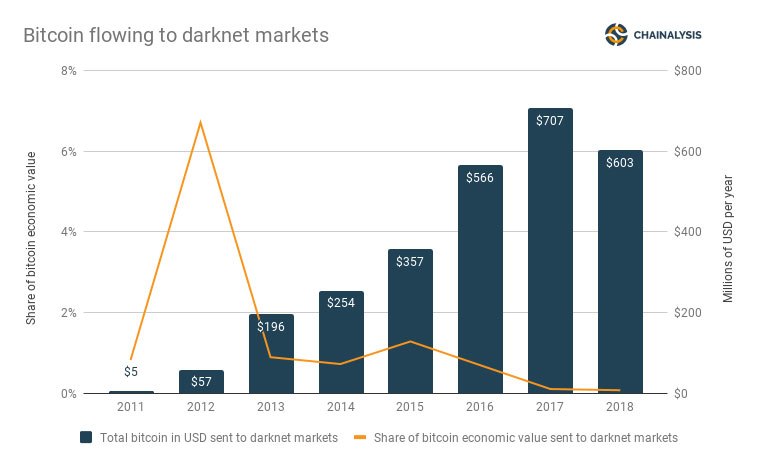

The initial association of cryptocurrency, particularly Bitcoin, with the darknet is undeniable. In the early days, platforms like Silk Road, an online black market, used Bitcoin as its primary currency. This association, while not representative of the technology's potential, created a lasting negative impression in the minds of many. The anonymity offered by Bitcoin made it an attractive tool for illegal activities, further solidifying this connection. However, it's crucial to remember that the darknet represents only a small fraction of the overall crypto ecosystem. The vast majority of Bitcoin and other cryptocurrencies are used for legitimate purposes, such as online payments, investments, and cross-border transactions. Over time, advancements in blockchain analytics and regulatory oversight have made it more difficult to use cryptocurrencies for illicit activities. The narrative has begun to shift as the legitimate use cases of crypto have become more prominent. In Indonesia, this shift has been aided by increased awareness campaigns and educational initiatives that highlight the potential benefits of crypto, such as financial inclusion and access to global markets. The government's efforts to regulate the industry have also played a crucial role in separating crypto from its darknet associations, establishing it as a legitimate asset class.

Debunking Crypto Myths in Indonesia

One of the biggest myths surrounding crypto in Indonesia is that it's solely a tool for criminals and money launderers. While the early association with the darknet certainly contributed to this perception, it's far from the complete picture. The reality is that the vast majority of crypto transactions are legitimate, and the technology has the potential to revolutionize various aspects of the Indonesian economy. Another common misconception is that crypto is too complex for the average person to understand. While the technical aspects of blockchain and cryptography can be daunting, using crypto is actually quite simple, thanks to user-friendly apps and platforms. Many Indonesians are already using crypto for everyday transactions, such as paying bills or sending money to family members abroad. A third myth is that crypto is a get-rich-quick scheme. While it's true that some people have made significant profits from crypto investments, it's important to remember that the market is highly volatile and there's always a risk of losing money. Responsible investing requires careful research, diversification, and a long-term perspective. Overcoming these myths is crucial for fostering wider adoption of crypto in Indonesia. Education and awareness campaigns, coupled with clear and consistent regulation, can help dispel misconceptions and promote a more balanced understanding of the technology's potential benefits and risks.

The Hidden Potential of Blockchain Technology

Beyond the speculative frenzy and price volatility, lies the true potential of blockchain technology, the underlying infrastructure that powers cryptocurrencies. This technology offers a level of transparency, security, and efficiency that traditional systems struggle to match. In Indonesia, blockchain has the potential to revolutionize various sectors, from supply chain management to land registration. Imagine a world where every transaction is recorded on an immutable ledger, easily accessible to all authorized parties. This could significantly reduce fraud and corruption, improve efficiency, and build trust across the board. For example, in the agricultural sector, blockchain could be used to track the origin and movement of goods, ensuring that consumers receive authentic and high-quality products. In the land registry, blockchain could provide a secure and transparent system for recording property ownership, reducing disputes and streamlining transactions. While the adoption of blockchain technology is still in its early stages in Indonesia, there is growing interest from both the public and private sectors. The government is exploring the use of blockchain for various applications, and several startups are developing innovative solutions based on the technology. Overcoming the technical challenges and regulatory hurdles will be crucial for realizing the full potential of blockchain in Indonesia. However, the potential benefits are too significant to ignore, and the country is well-positioned to become a leader in blockchain innovation.

Recommendations for Navigating the Crypto Landscape in Indonesia

For those interested in exploring the world of cryptocurrency in Indonesia, it's important to approach it with caution and a clear understanding of the risks involved. First and foremost, do your research. Don't blindly follow investment advice from social media or online forums. Take the time to learn about the underlying technology, the different types of cryptocurrencies, and the factors that influence their price. Secondly, choose a reputable exchange or platform. There are many crypto exchanges operating in Indonesia, but not all of them are created equal. Look for exchanges that are registered with the relevant regulatory authorities, have strong security measures in place, and offer good customer support. Thirdly, start small. Don't invest more than you can afford to lose. The crypto market is highly volatile, and prices can fluctuate dramatically in short periods. It's important to be prepared for potential losses and not put all your eggs in one basket. Fourthly, diversify your portfolio. Don't invest all your money in a single cryptocurrency. Spread your investments across different assets to reduce your risk. Finally, stay informed. The crypto landscape is constantly evolving, with new technologies, regulations, and market trends emerging all the time. Stay up-to-date on the latest developments to make informed investment decisions.

The Role of Regulation in Shaping Public Perception

Regulation plays a pivotal role in shaping public perception of cryptocurrency. In Indonesia, the government's approach to regulating the crypto industry has been cautious but progressive. On one hand, they want to protect consumers from fraud and illegal activities. On the other hand, they recognize the potential benefits of crypto and don't want to stifle innovation. The key is to strike a balance between these two competing goals. Clear and consistent regulation can help build trust and legitimacy in the crypto market, encouraging wider adoption and investment. It can also help deter illegal activities, such as money laundering and tax evasion. However, overly restrictive regulations can stifle innovation and drive businesses to other jurisdictions. The ideal regulatory framework should be flexible enough to adapt to the rapidly evolving nature of the crypto industry, while also providing adequate consumer protection and preventing illegal activities. This requires ongoing dialogue between regulators, industry players, and the public. In Indonesia, the government has taken steps to regulate crypto exchanges and virtual asset service providers. They have also issued guidelines on anti-money laundering and counter-terrorism financing. However, there is still a need for more comprehensive and clearer regulations, particularly in areas such as taxation and security token offerings. A well-defined regulatory framework will not only protect consumers and prevent illegal activities but also attract more investment and foster innovation in the Indonesian crypto market.

Tips for Investing Responsibly in Crypto

Investing in cryptocurrency can be exciting, but it's crucial to approach it responsibly. First, educate yourself thoroughly. Understand the technology, the specific cryptocurrencies you're considering, and the market dynamics. Don't rely solely on social media hype or advice from unqualified sources. Second, define your investment goals and risk tolerance. Are you looking for short-term gains or long-term growth? How much risk are you comfortable taking? Your investment strategy should align with your goals and risk tolerance. Third, start small and diversify. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies and other asset classes to mitigate risk. Fourth, use a secure wallet. Choose a reputable wallet provider and enable two-factor authentication to protect your funds from hackers. Fifth, be wary of scams and Ponzi schemes. If something sounds too good to be true, it probably is. Do your due diligence before investing in any project or platform. Sixth, monitor your investments regularly. Keep an eye on market trends and adjust your portfolio as needed. However, avoid making impulsive decisions based on short-term price fluctuations. Seventh, be prepared to lose money. The crypto market is highly volatile, and there's always a risk of losing your entire investment. Only invest what you can afford to lose. Finally, stay informed about regulations. The regulatory landscape for crypto is constantly evolving. Stay up-to-date on the latest regulations in your jurisdiction to ensure you're complying with the law.

The Impact of Social Media on Crypto Adoption

Social media has played a significant role in the adoption of cryptocurrency, both positively and negatively. On the one hand, social media platforms have democratized access to information and allowed people to connect with each other and share their experiences with crypto. This has helped to raise awareness and educate the public about the technology. Social media has also facilitated the creation of online communities where people can discuss crypto, ask questions, and share investment strategies. However, social media can also be a breeding ground for misinformation and scams. The anonymity of the internet allows unscrupulous individuals to spread false information and promote fraudulent schemes. The herd mentality that often prevails on social media can also lead to irrational investment decisions and market bubbles. It's important to be critical of information you find on social media and to do your own research before making any investment decisions. Look for reputable sources of information and be wary of hype and promises of guaranteed returns. Social media can be a valuable tool for learning about crypto and connecting with other enthusiasts, but it's important to use it responsibly and to be aware of its limitations. In Indonesia, social media influencers have played a significant role in promoting crypto to their followers. While some of these influencers provide valuable information and insights, others are simply shilling projects for personal gain. It's important to be discerning and to evaluate the information you receive from social media influencers carefully.

Fun Facts About Crypto in Indonesia

Did you know that Indonesia is one of the most crypto-enthusiastic countries in Southeast Asia? Despite the regulatory uncertainties, the adoption of cryptocurrencies has been growing rapidly in recent years. Here are some fun facts: Indonesia has a large and active crypto community, with numerous online forums, meetups, and conferences dedicated to the topic. Bitcoin is the most popular cryptocurrency in Indonesia, followed by Ethereum and other altcoins. Many Indonesian businesses are starting to accept crypto as a form of payment, particularly in the tourism and hospitality sectors. The Indonesian government has been exploring the use of blockchain technology for various applications, such as land registration and supply chain management. Indonesia is home to several successful crypto startups, developing innovative solutions for the local market. The number of crypto investors in Indonesia has been growing exponentially, particularly among young people. Many Indonesians are using crypto to send remittances to family members abroad, as it's often cheaper and faster than traditional methods. The Indonesian government is working on developing a comprehensive regulatory framework for the crypto industry to protect consumers and prevent illegal activities. Despite the challenges, the future of crypto in Indonesia looks bright, with growing adoption, innovation, and regulatory clarity. Indonesia has the potential to become a major player in the global crypto economy.

Cara Get Started with Crypto in Indonesia

Getting started with cryptocurrency in Indonesia is easier than you might think. First, choose a reputable crypto exchange that operates in Indonesia. Some popular options include Indodax, Tokocrypto, and Pintu. Make sure the exchange is registered with BAPPEBTI, the Indonesian Commodity Futures Trading Regulatory Agency. Second, create an account on the exchange and complete the verification process. This typically involves providing personal information and uploading a copy of your ID. Third, deposit funds into your account. You can usually do this via bank transfer or other payment methods. Fourth, choose the cryptocurrency you want to buy. Bitcoin and Ethereum are popular choices for beginners. Fifth, place an order to buy the cryptocurrency. You can usually choose between a market order (which executes immediately at the current price) or a limit order (which executes when the price reaches a certain level). Sixth, store your cryptocurrency securely. You can either leave it on the exchange (which is convenient but less secure) or transfer it to a personal wallet (which is more secure but requires more technical knowledge). There are many different types of wallets available, including software wallets, hardware wallets, and paper wallets. Seventh, monitor your investments and rebalance your portfolio as needed. The crypto market is highly volatile, so it's important to stay informed and adjust your strategy accordingly. Finally, be patient and don't expect to get rich overnight. Investing in crypto is a long-term game, and it's important to be prepared for ups and downs.

Bagaimana jika Crypto Becomes the Dominant Currency?

Imagining a world where cryptocurrency becomes the dominant currency is a thought experiment that raises many intriguing questions. What would the implications be for central banks and monetary policy? How would governments collect taxes and regulate financial institutions? What would happen to the traditional banking system? In such a scenario, central banks would likely lose their control over the money supply, as cryptocurrencies are decentralized and not controlled by any single entity. This could make it more difficult for governments to manage inflation and stimulate economic growth. Governments would also need to find new ways to collect taxes, as crypto transactions are often anonymous and difficult to track. The traditional banking system would likely face significant disruption, as people would no longer need banks to store and transfer their money. However, a crypto-dominated world could also offer significant benefits. It could lead to greater financial inclusion, as people without bank accounts could easily access crypto-based financial services. It could also reduce transaction costs, as crypto transactions are typically cheaper than traditional payment methods. Furthermore, it could increase transparency and reduce corruption, as all crypto transactions are recorded on a public ledger. Whether cryptocurrency will ever become the dominant currency is a matter of debate. However, it's important to consider the potential implications of such a scenario, both positive and negative. In Indonesia, a crypto-dominated economy could have significant implications for the country's financial system and economic development. The government would need to adapt its policies and regulations to take account of the new reality.

Top 5 Crypto to Invest in Indonesia

Choosing which cryptocurrencies to invest in can be a daunting task, especially for beginners. Here's a list of five cryptocurrencies that are popular in Indonesia, along with some considerations:

- Bitcoin (BTC): The original cryptocurrency and still the most dominant in terms of market capitalization and adoption. Bitcoin is often seen as a store of value and a hedge against inflation.

- Ethereum (ETH): The second-largest cryptocurrency, Ethereum is a platform for building decentralized applications (d Apps) and smart contracts. Ethereum is seen as a more versatile cryptocurrency than Bitcoin.

- Binance Coin (BNB): The native cryptocurrency of the Binance exchange, BNB is used to pay for transaction fees on the Binance platform. BNB has also expanded its use cases beyond the Binance ecosystem.

- Cardano (ADA): A proof-of-stake blockchain platform that aims to be more scalable, secure, and sustainable than previous generations of blockchain technology. Cardano is known for its strong research focus.

- Solana (SOL): A high-performance blockchain platform that is designed for speed and scalability. Solana is often used for decentralized finance (De Fi) applications and non-fungible tokens (NFTs).

It's important to note that this is not financial advice, and you should do your own research before investing in any cryptocurrency. The crypto market is highly volatile, and prices can fluctuate dramatically in short periods. Only invest what you can afford to lose.

Pertanyaan dan Jawaban tentang Crypto in Indonesia

Here are some frequently asked questions about cryptocurrency in Indonesia:

Question 1: Is cryptocurrency legal in Indonesia?

Answer: Yes, cryptocurrency trading is legal in Indonesia. However, using cryptocurrency as a means of payment is not allowed.

Question 2: How is cryptocurrency taxed in Indonesia?

Answer: Cryptocurrency gains are subject to income tax in Indonesia. You are required to report your crypto gains as part of your annual tax return.

Question 3: What are the risks of investing in cryptocurrency?

Answer: The main risks of investing in cryptocurrency include price volatility, regulatory uncertainty, and the potential for fraud and scams.

Question 4: Where can I buy cryptocurrency in Indonesia?

Answer: You can buy cryptocurrency on registered crypto exchanges in Indonesia, such as Indodax, Tokocrypto, and Pintu.

Kesimpulan tentang Dari Darknet ke Mainstream: Evolusi Persepsi Publik terhadap Crypto

The journey of cryptocurrency in Indonesia has been a fascinating one, marked by a significant shift in public perception. From its initial association with the darknet and illicit activities, crypto has gradually gained acceptance and legitimacy, becoming a topic of mainstream discussion and even attracting interest from traditional financial institutions. This evolution has been driven by several factors, including increased media coverage, growing adoption by individuals and businesses, government regulation, and the recognition of the potential benefits of blockchain technology. While challenges remain, such as regulatory uncertainty and market volatility, the future of crypto in Indonesia looks promising. As the technology continues to evolve and mature, and as the regulatory landscape becomes clearer, crypto is likely to play an increasingly important role in the Indonesian financial landscape.